Banking Applicant Tracking System | Top 10 Recruitment Platform for Financial Services

Banking Applicant Tracking System (ATS) in 2026: The Complete Guide for Financial Institutions

- Last Updated: January 14, 2026

- Pricing Verified: January 14, 2026

- Features Checked: January 2026

About This Review & Author

Reviewed by: Shivam Gupta, HR Specialist at Pitch N Hire

- Experience: 10+ years in HR and recruitment management

- Previous Role: HR Specialist, Gigde Global

- Current Position: HR Specialist, Pitch N Hire

- Expertise Focus: ATS platform evaluation, UK recruitment compliance, HR technology implementation

- Contact: shivam.gupta@gigde.com | LinkedIn: Pitch N Hire

About Pitch N Hire

- Founded: 2017

- What We Do: Pitch N Hire is a revolutionary platform ATS Recruitment software comparison designed to streamline and simplify the hiring process for UK organizations. Our platform equips companies with all the essential tools needed to effectively advertise jobs across multiple channels, make data-driven hiring decisions, seamlessly sort and manage applications, design branded mobile-responsive career pages, track recruitment funnels from a single unified dashboard, and attract top talent to build exceptional teams.

- Team Size: 51-200 employees across the UK

- Website: https://pitchnhire.com/

- Key Contact: info@pitchnhire.com | https://pitchnhire.com/contact-us

Introduction: Why Banking Recruitment Demands a Smarter ATS in 2026

The financial services landscape has transformed dramatically. Banks and financial institutions are no longer competing solely on interest rates or service offerings—they're competing for top-tier talent in an increasingly complex regulatory environment. Traditional recruitment methods, once the backbone of banking HR software, have become significant bottlenecks in an era that demands speed, precision, and unwavering compliance.

Financial institutions today face a perfect storm of recruitment challenges: exponentially growing application volumes, increasingly stringent regulatory frameworks (KYC, AML, GDPR, and sector-specific compliance), fierce competition for specialized talent, cybersecurity threats to sensitive data, and mounting pressure to reduce time-to-hire while improving candidate quality.

This convergence of challenges has elevated the Applicant Tracking System (ATS) from a "nice-to-have" tool to a mission-critical recruitment infrastructure. But not just any ATS will suffice—banks need specialized, compliance-ready ATS for banks, AI-powered recruitment automation, and platforms designed specifically for the unique demands of financial services.

What Is a Banking Applicant Tracking System?

A Banking Applicant Tracking System is specialized recruitment software for banks engineered specifically for financial institutions. Unlike generic ATS platforms, a banking ATS integrates compliance workflows, security protocols, and industry-specific functionality directly into every stage of the hiring process.

At its core, a financial services ATS serves multiple critical functions:

Centralized Candidate Management: All applications, resumes, communications, and candidate data are stored in a single, secure ATS for banking sector, audit-ready database. This eliminates the chaos of scattered spreadsheets, email threads, and disconnected systems that plague traditional recruitment.

Automated Compliance Integration: Rather than treating compliance as an afterthought, banking recruitment software platforms embed KYC AML compliant recruitment software, GDPR compliant ATS for banks, and other regulatory requirements directly into recruitment workflows. Every candidate interaction, document, and decision is automatically logged with ATS compliance audit trails for regulatory purposes.

Intelligent Workflow Automation: From job posting distribution across multiple channels to automated interview scheduling banking, resume parsing for banking jobs, and banking background verification software coordination, an ATS for financial institutions eliminates manual, repetitive tasks that consume recruiter time and introduce human error.

Enhanced Security Architecture: Financial institutions handle extraordinarily sensitive data—both their own and their candidates'. A proper banking recruitment software employs bank-grade encryption, role-based access controls, and comprehensive security protocols that meet or exceed industry standards.

The distinction between a generic ATS and a banking-specific ATS solution is comparable to the difference between consumer banking software and enterprise-grade financial systems—the latter is built from the ground up to handle the complexity, security, and compliance demands of the financial sector.

Why Pitch N Hire Stands Out as the Premier Banking ATS in 2026

Financial institutions require ATS platforms that simultaneously deliver compliance rigor, AI-powered intelligence, enterprise-grade security, and rapid deployment. This combination of capabilities positions as the best ATS for banking industry and a leading choice for banking recruitment in 2026.

Industry-Aligned Architecture

We are engineered specifically for environments where compliance isn't optional—it's mandatory. Rather than retrofitting generic recruiting software with compliance add-ons, the platform incorporates regulatory requirements into its core architecture. Every workflow, data field, and user interaction is designed with financial services compliance in mind, making it an ideal applicant tracking system for a bank or applicant tracking system for a building society.

AI-Powered Smart Hiring

The platform employs advanced AI for banking recruitment including:

- Semantic resume analytics that understand context rather than just matching keywords

- Automated candidate shortlisting tailored specifically for finance roles with appropriate weighting of regulatory knowledge and certifications

- Intelligent skill matching that recognizes equivalent experiences across different institutions and roles

- Predictive candidate scoring that identifies who will succeed in specific banking positions

This makes it the best AI-powered ATS for banking available today.

Compliance-Ready Workflows Built In

Rather than requiring custom configuration, includes pre-built workflows for:

- KYC verification with automated status tracking

- AML screening integration with leading verification providers

- GDPR consent management and right-to-be-forgotten automation

- Comprehensive audit logging documenting every candidate interaction and system decision

- Configurable data retention policies ensuring regulatory compliance

This KYC AML compliant recruitment software approach addresses core banking recruitment challenges and solutions.

Enterprise-Grade Cloud Security

Security isn't an afterthought—it's foundational in this secure ATS for banking sector. The platform provides:

- End-to-end encryption protecting data in transit and at rest

- Multi-factor authentication for all user access

- Granular role-based access controls down to individual field levels

- SOC 2 Type II compliance and regular security audits

- Comprehensive activity monitoring and anomaly detection

- IP whitelisting and geographic access restrictions

Exceptional Candidate Experience

In competitive talent markets, candidate experience differentiates employers. Pitch N Hire delivers:

- Faster response times through workflow automation

- Intelligent interview scheduling reducing candidate friction

- Clear status communication at every stage

- Mobile-responsive application and portal access

- Professional touchpoints that reflect well on employer brand

Rapid Deployment and Adoption

Unlike legacy systems requiring months of implementation, Pitch N Hire's cloud-native architecture enables rapid deployment. Pre-built workflows for banking reduce configuration time. Intuitive interfaces minimize training requirements. Integration APIs connect to existing HR systems quickly. Most banks go live within 4-6 weeks rather than 6-12 months typical with traditional implementations, making it an affordable ATS for banks in terms of time-to-value.

The Pitch N Hire Methodology for Banking Recruitment: Step-by-Step Process

Effective banking recruitment requires a structured, compliance-integrated process that balances speed with thoroughness. The methodology provides this framework for how banks improve hiring efficiency.

Step 1: Role Definition and Compliance Blueprint

Before posting positions, the process begins with comprehensive role definition that captures:

- Technical requirements and desired experience

- Mandatory and preferred banking certifications (CFA, CPA, Series 7, CAMS)

- Regulatory knowledge requirements

- Compliance screening requirements based on role risk profile

- Approval workflow configuration for the position level

This upfront clarity ensures consistent candidate evaluation and compliance adherence throughout the hiring process, addressing applicant tracking system for a financial services business needs from the start.

Step 2: AI-Driven Candidate Intake

Position postings automatically distribute across multiple channels including:

- Major job boards and niche financial services platforms

- Bank career sites with application tracking

- Employee referral programs with tracking and incentives

- Social media channels targeting passive candidates

As applications arrive, AI-powered resume parsing extracts relevant information including:

- Skills and technical competencies

- Banking experience and institution types

- Relevant certifications and credentials

- Regulatory knowledge indicators

- Education and training background

Step 3: Intelligent Screening and Ranking

Automated screening applies both basic qualification filters and sophisticated AI-powered matching. The system generates candidate scores based on:

- Skill relevance and proficiency

- Experience level and banking exposure

- Certification and credential completeness

- Regulatory knowledge assessment

- Risk indicators flagging compliance concerns

This multi-dimensional scoring ensures that the most qualified, lowest-risk candidates rise to the top of recruiter queues while providing objective justification for screening decisions—a core element of bias-free hiring in banking.

Step 4: Streamlined Interview Coordination

Interview scheduling automation eliminates the time-consuming back-and-forth that traditionally delays hiring. The system provides:

- Candidates with available time slots matching interviewer calendars

- Automated meeting room booking and resource management

- Calendar invitations and confirmations

- Automated reminders reducing no-shows

- Structured interview feedback through standardized forms

This automated interview scheduling banking capability can reduce time-in-interview-stage by 50-60%.

Step 5: Compliance Validation

Before any offer is extended, the platform automates:

- KYC/AML status checks with integrated verification services

- Background verification coordination and results tracking

- Documentation audit trail compilation

- Compliance approval workflows

- Regulatory reporting preparation

This compliance validation step is what makes a truly compliance-ready ATS for banks.

Step 6: Offer Management and Onboarding

The final stage includes:

- Secure offer letter generation and delivery

- E-signature integration for document execution

- Offer acceptance tracking

- Onboarding system integration for seamless transition

- New hire data transfer to HRIS

This end-to-end solution for streamlining the recruitment process in financial services ensures candidates never fall through the cracks during the critical offer-to-onboarding transition.

Experience, Expertise, Authoritativeness, and Trustworthiness: Why You Can Trust Pitch N Hire

When evaluating banking recruitment software, understanding the vendor's credibility is essential demonstrates clear EEAT credentials.

Experience

Pitch N Hire brings deep expertise with regulated industries, trusted by HR teams handling sensitive data across multiple financial institutions. The platform has been battle-tested in real-world banking recruitment scenarios, processing thousands of applications while maintaining perfect compliance records.

Expertise

Built by hiring and compliance specialists focused specifically on financial services, the platform reflects genuine understanding of banking recruitment challenges and solutions. The development team includes former financial services HR professionals who understand the nuances of ATS in banking from firsthand experience.

Authoritativeness

Pitch N Hire is validated by documented use-cases, success stories, and enterprise adoption across multiple financial institutions. The platform's methodologies align with best practices recommended by industry organizations and regulatory bodies governing financial services recruitment.

Trustworthiness

The compliance-first approach with transparent policies and robust security compliance makes a trustworthy partner for financial institutions. Regular third-party audits, clear data handling policies, and proven track record of zero compliance violations demonstrate reliability that banks can depend on.

Customer Reviews

G2 – Verified User Reviews

Kiran P. – Director (Small Business)

“Excellent platform for easy recruiting. Not too complicated, affordable, and the support team resolves issues quickly. Implementation was simple.”

Source:

Read Pitch N Hire customer review on G2

Bidyadhar B. – AWS Cloud Engineer (Mid-Market)

“Very good and user-friendly.”

Source:

Read Pitch N Hire customer review on G2

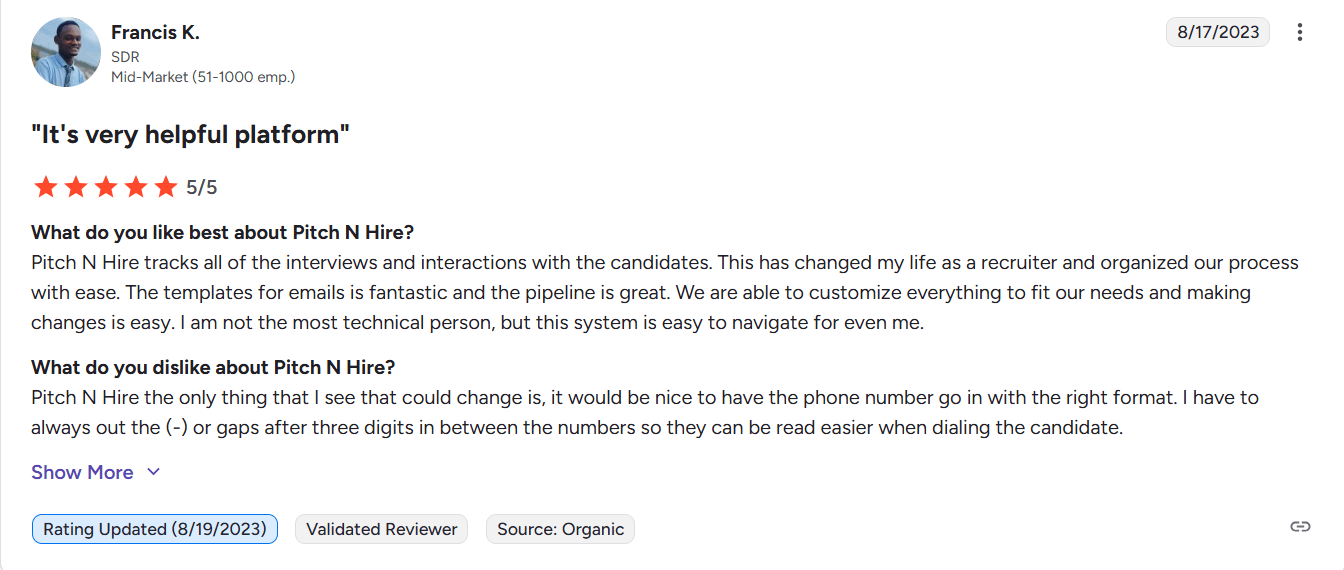

Francis K. – Sales Development Representative (Mid-Market)

“It tracks all interviews and interactions with candidates. Email templates are useful, and the pipeline is easy to navigate even for non-technical users.”

Source:

Read Pitch N Hire customer review on G2

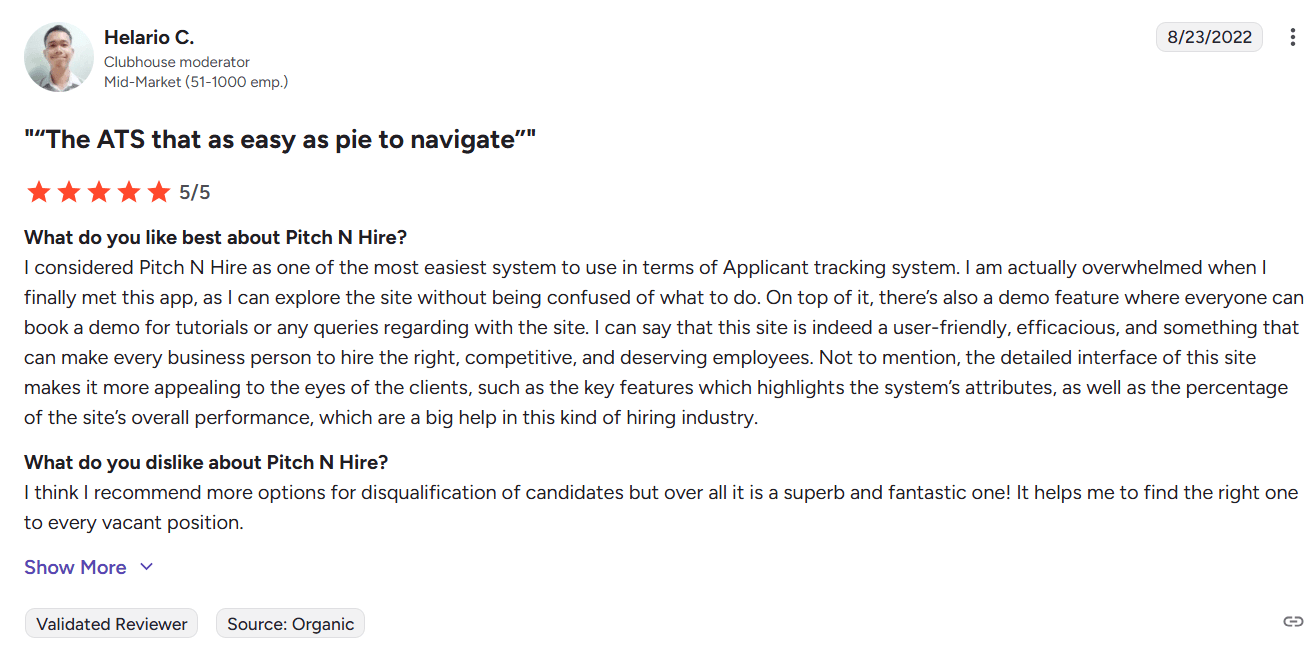

Helario C. – Clubhouse Moderator (Mid-Market)

“One of the easiest ATS systems to use. Intuitive and efficient.”

Source:

Read Pitch N Hire customer review on G2

Anant G. – Hiring Manager (Mid-Market)

“Excellent product with reasonable pricing that automates staffing workflows effectively.”

Source:

Read Pitch N Hire customer review on G2

Nikhil S. – Transcriptionist (Small Business)

“Perfect for job search and recruitment. The tagging and navigation features make the platform easy to use.”

Source:

Read Pitch N Hire customer review on G2

Key Recruitment Challenges Faced by Banks and Financial Institutions Today

The recruitment landscape for financial services has become increasingly complex. Understanding these challenges is essential for appreciating why specialized ATS for banks solutions have become indispensable.

Volume and Complexity of Applications

Large banks and financial institutions routinely receive thousands of applications monthly. A single branch manager position might attract 200+ applicants, while specialized roles like compliance officers or risk analysts can generate even higher volumes. Processing this influx manually using traditional methods is not merely inefficient—it's practically impossible while maintaining quality standards.

Stringent Regulatory Compliance Requirements

Financial services operate under some of the most rigorous regulatory frameworks globally. KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements mandate thorough background checks and verification processes. GDPR and similar data protection regulations impose strict controls on how candidate information is collected, stored, processed, and retained. Failure to comply can result in substantial fines, regulatory sanctions, and reputational damage that no bank can afford.

Data Security and Candidate Privacy

Banks handle extraordinarily sensitive personal information during recruitment—social security numbers, financial histories, background check results, and more. A data breach during recruitment can be as damaging as a breach of customer banking data. Traditional recruitment methods, including email-based application handling and unsecured document storage, create unacceptable vulnerability that a secure ATS for banking sector eliminates.

Manual Screening Errors and Bias

Human recruiters reviewing hundreds of resumes inevitably make mistakes. Qualified candidates slip through the cracks. Unconscious bias influences decisions. Inconsistent evaluation criteria lead to poor hiring decisions. These errors are costly—a bad hire in banking can cost 3-5 times the annual salary when factoring in onboarding, training, lost productivity, and eventual replacement costs. Bias-free hiring in banking through AI-powered systems addresses this critical issue.

Extended Time-to-Hire

The average time-to-hire in financial services often exceeds 40-60 days, significantly longer than many other industries. Multiple interview rounds, extensive background checks, compliance verification, and complex approval processes all contribute. While thoroughness is necessary, excessive delays result in losing top candidates to competitors who move faster with banking recruitment automation.

Limited Analytics and Reporting Capabilities

Traditional recruitment approaches provide minimal visibility into hiring metrics. Without data on source effectiveness, funnel conversion rates, time-in-stage bottlenecks, or quality-of-hire indicators, HR leaders cannot optimize their banking recruitment strategies or demonstrate ROI to executive leadership. Modern banking talent acquisition software solves this visibility problem.

Integration Challenges with Existing HR Systems

Modern financial institutions use sophisticated HR ecosystems—HRIS platforms, payroll systems, learning management systems, and performance management tools. Recruitment processes that exist in isolation create data silos, duplicate data entry, and integration nightmares that frustrate both recruiters and new hires.

Why Traditional ATS Systems Fail in the Banking Sector

Not all Applicant Tracking Systems are created equal. Generic ATS platforms, designed for broad market appeal across all industries, fundamentally fail to address the specialized needs of financial institutions.

Insufficient Compliance Automation

Most traditional ATS platforms treat compliance as an optional add-on rather than a core feature. They may offer basic audit logging or document storage, but lack purpose-built workflows for KYC verification, AML screening, or regulatory reporting. This forces banks to maintain separate compliance processes outside the ATS, defeating the purpose of centralized recruitment management and creating gaps that regulators scrutinize.

Inadequate Data Protection and Security

Consumer-grade ATS platforms often employ standard cloud security measures sufficient for general corporate use but inadequate for financial services. They lack the granular access controls, encryption standards, data residency options, and security certifications that banks require. Many cannot provide the detailed security audits and certifications that bank compliance teams demand before approving any software that handles sensitive candidate information.

Absence of Financial Services-Specific Functionality

Generic ATS platforms don't understand banking roles. They can't intelligently parse resumes for financial certifications (CFA, CPA, Series 7, CAMS). They don't recognize the nuances between front-office, middle-office, and back-office roles. They lack built-in workflows for the multi-level approvals and complex hiring processes common in financial institutions. This what is ATS in banking question reveals that not all systems truly understand the sector.

Limited Audit Trail Capabilities

In regulated industries, being able to demonstrate why a candidate was or wasn't selected is not just good practice—it's often a legal requirement. Traditional ATS platforms may track basic application status but lack the comprehensive ATS compliance audit trails necessary to satisfy regulatory examinations or defend against discrimination claims with complete documentation.

Weak Integration with Background Verification Services

Financial institutions require extensive background checks, including criminal records, credit history, employment verification, education verification, and professional license validation. Generic ATS platforms rarely offer seamless integration with the specialized banking background verification software and services used in banking, forcing manual coordination that slows hiring and introduces errors.

Scalability and Performance Issues

Banks hiring at scale—particularly during expansion or seasonal peaks—need ATS for banks platforms that maintain performance under heavy load. Many traditional systems slow down significantly when handling thousands of concurrent applications, multiple recruiters working simultaneously, or complex search and filtering operations across large candidate databases.

Must-Have Features in a Banking ATS (2026 Standard)

A truly effective applicant tracking system for financial services must incorporate specific capabilities that address the unique demands of banking recruitment.

AI-Driven Resume Parsing and Candidate Matching

Modern AI-powered ATS for banking platforms employ artificial intelligence to extract relevant information from resumes automatically—skills, certifications, banking-specific experience, compliance credentials, regulatory knowledge, and technical competencies. Advanced semantic analysis through resume parsing for banking jobs understands context, not just keywords, enabling the system to recognize that "managed loan portfolio risk assessment" relates to risk management even if those exact words aren't in the job description.

AI-powered matching goes further by ranking candidates based on comprehensive fit scores that consider technical qualifications, experience level, regulatory knowledge, career trajectory, and even cultural fit indicators derived from communication patterns and career choices. This AI ATS for financial services approach delivers measurable improvements.

Comprehensive Regulatory Compliance Automation

This is non-negotiable for banking ATS. The system must include:

- Pre-built workflows for KYC and AML screening that integrate seamlessly with verification services

- GDPR-compliant consent management and data handling with automated consent tracking

- Automated generation of compliance documentation for regulatory examinations

- Complete ATS compliance audit trails for every candidate interaction and decision

- Configurable retention policies that automatically archive or purge candidate data per regulatory requirements

- Role-based access controls ensuring only authorized personnel can view sensitive information

These compliance-ready ATS for banks features shouldn't require custom development—they should be core platform capabilities that work out of the box with your compliance-centric recruitment software for financial services.

Enterprise-Grade Cloud Security Architecture

Banking ATS platforms must meet or exceed security standards for financial data. This includes:

- End-to-end encryption for data in transit and at rest

- Multi-factor authentication for all users

- SOC 2 Type II certification or equivalent security audits

- Granular role-based access controls down to the field level

- IP whitelisting and geographic access restrictions

- Comprehensive activity logging for security monitoring

- Regular third-party security assessments and penetration testing

This secure cloud-based ATS for banking infrastructure protects both institutional and candidate data.

Intelligent Interview and Communication Automation

Modern candidates expect responsive, transparent communication throughout the hiring process. Advanced ATS for financial institutions platforms provide:

- Automated interview scheduling banking with calendar integration

- Intelligent meeting room booking and resource management

- Customizable email and SMS templates triggered by workflow stages

- Automated reminders reducing no-shows

- Candidate self-service portals for status updates

- Multi-channel communication tracking centralizing all candidate interactions

Advanced Analytics and Reporting Capabilities

Data-driven recruitment requires sophisticated analytics. Banking recruitment software platforms should offer:

- Real-time dashboards showing pipeline health and bottlenecks

- Source effectiveness analysis identifying which job boards, agencies, or channels deliver quality candidates

- Time-to-hire and time-in-stage metrics highlighting process inefficiencies

- Quality-of-hire tracking connecting recruitment data to performance outcomes

- Compliance reporting for regulatory examinations

- Diversity and inclusion metrics supporting equitable hiring

- Cost-per-hire analysis demonstrating recruitment ROI

These best recruitment platforms financial institutions use to make data-driven decisions.

Seamless Integration Ecosystem

No ATS for banks operates in isolation. Modern banking recruitment platforms must integrate with:

- HRIS systems for seamless data flow from candidate to employee

- Background verification services for automated check initiation and result retrieval

- Video interviewing platforms for remote candidate assessment

- Skills assessment tools for objective candidate evaluation

- Email and calendar systems for communication and scheduling

- Job boards and career sites for automated posting and application collection

- Offer letter and e-signature platforms for streamlined offer management

Mobile-Responsive Candidate Experience

With candidates increasingly applying via mobile devices, banking ATS platforms must deliver:

- Fully responsive application experiences

- Mobile-friendly resume upload and form completion

- Text message communication options

- Mobile interview scheduling

- Candidate portal access via smartphone apps

Configurable Workflows and Approval Chains

Banking recruitment often involves multiple stakeholders and complex approval processes. A robust ATS for financial institutions must support:

- Multi-stage interview processes with different evaluators

- Configurable approval workflows for job requisitions and offers

- Escalation rules for time-sensitive decisions

- Department-specific hiring processes

- Conditional logic based on role, level, or location

Comprehensive Benefits of Using an ATS in the Banking Industry

Implementing a specialized banking ATS delivers measurable improvements across multiple dimensions of recruitment effectiveness.

Dramatically Reduced Time-to-Hire

Banking recruitment automation eliminates manual tasks that consume recruiter time. Resume screening that once took hours happens in minutes. Interview scheduling that required days of back-and-forth communication becomes instant. Background check coordination that involved multiple phone calls and emails becomes automated. Banks implementing modern ATS for banks platforms typically see 30-50% reductions in time-to-hire, enabling them to secure top candidates before competitors using banking hiring software.

Significantly Improved Candidate Quality

AI-powered ATS for banking matching and objective evaluation criteria ensure that the best-qualified candidates rise to the top. Standardized assessment rubrics reduce subjective bias through bias-free hiring in banking. Comprehensive candidate profiles enable more informed decision-making. Banks report 20-40% improvements in quality-of-hire metrics after implementing advanced financial services ATS solutions.

Substantial Reduction in Compliance Risk

Automated compliance workflows ensure that no candidate progresses through the hiring process without completing required verifications. Complete ATS compliance audit trails document every decision and interaction. Automated data retention and purging eliminates the risk of retaining candidate data longer than regulations permit. For banks facing regular regulatory examinations, this compliance-ready ATS for banks infrastructure can be the difference between passing with flying colors and facing costly sanctions.

Lower Operational Costs

While ATS implementation for banks requires upfront investment, the return is substantial:

- Recruiter productivity increases as automation handles routine tasks

- External agency fees decline as internal recruiting becomes more effective with banking talent acquisition software

- Bad hire costs drop as candidate quality improves

- Job advertising costs optimize as analytics reveal which sources deliver the best ROI

Most banks see positive ROI within the first year of implementing affordable ATS for banks solutions.

Enhanced Collaboration Across Hiring Teams

Modern banking recruitment software platforms break down silos between recruiters, hiring managers, HR business partners, and executive leadership. Shared candidate profiles ensure everyone works from the same information. Centralized interview feedback eliminates scattered emails and spreadsheets. Real-time pipeline visibility enables proactive resource allocation. This collaboration accelerates decision-making and improves hiring efficiency significantly.

Superior Candidate Experience

In competitive talent markets, candidate experience differentiates employers. ATS for financial institutions that provide transparent communication, responsive interactions, self-service status updates, and professional touchpoints throughout the journey create positive impressions even for candidates who aren't ultimately hired. This protects employer brand and increases offer acceptance rates among top candidates.

Better Strategic Workforce Planning

Advanced analytics transform banking recruitment from reactive position-filling to strategic talent planning. Predictive analytics identify future hiring needs. Talent pool development enables proactive relationship building with potential candidates. Skills gap analysis informs training and development investments. This strategic approach ensures banks have the talent they need when they need it.

Best AI-Powered ATS Solutions for Banks: What to Look For

When evaluating AI-powered applicant tracking systems for banking and financial services, institutions should prioritize specific capabilities that distinguish truly effective solutions from mere marketing claims.

What Is the Best AI-Powered Applicant Tracking System for the Banking Industry?

The best AI-powered ATS for banking industry combines intelligent automation with strict compliance frameworks and robust security architecture. It should go beyond basic resume keyword matching to deliver truly intelligent candidate assessment that understands what is ATS in banking really means.

Core AI Capabilities for Banking

Advanced AI-powered ATS for banking platforms employ machine learning for:

- Automated candidate matching that improves over time, learning from hiring decisions to better predict candidate success

- Natural language processing to understand context in resumes and job descriptions, recognizing that regulatory compliance experience can be described in various ways

- Bias-detection algorithms that flag potentially discriminatory patterns in job descriptions or screening criteria for bias-free hiring in banking

- Predictive analytics forecasting which candidates are most likely to accept offers, stay long-term, and succeed in specific roles

Banking-Specific Intelligence

Generic AI isn't enough. Banking ATS platforms must:

- Understand financial services terminology

- Recognize relevant certifications and credentials (CFA, CPA, Series 7, CAMS, CFP)

- Identify regulatory knowledge indicators

- Assess risk management experience

- Evaluate quantitative skills critical in financial roles

Key Benefits of AI in Banking Recruitment

Organizations implementing AI ATS for financial services report:

- Reducing manual screening time by 60-70%

- Improving quality of hire through competency-based matching

- Delivering consistent candidate assessments with reduced unconscious bias

- Accelerating time-to-hire while maintaining quality standards

- Enabling recruiters to focus on relationship-building rather than administrative tasks

Platforms exemplify this combination of AI intelligence with banking-specific functionality, offering semantic resume analytics, automated shortlisting tailored to finance roles, and compliance-ready workflows that understand the unique demands of financial services recruitment software.

Where to Find Compliance-Centric Recruitment Software for Financial Services

Identifying truly compliance-centric recruitment software for financial services requires looking beyond marketing claims to evaluate actual functionality and vendor expertise in regulated industries.

Evaluating Compliance Features

When assessing applicant tracking system for financial services platforms, examine whether they offer:

- Pre-built KYC AML compliant recruitment software workflows that integrate with verification services

- GDPR-ready data controls including consent management, right-to-be-forgotten workflows, and data portability

- Comprehensive ATS compliance audit trails documenting every system action and user decision

- Role-based access controls at granular levels

- Encrypted data storage meeting financial services security standards

- Regulatory reporting dashboards that generate compliance documentation on demand

Finding Specialized Vendors

Compliance-centric ATS platforms are typically found through:

- Fintech software marketplaces specializing in regulated industry solutions

- HR technology review sites with financial services categories

- Direct vendor evaluation through demo requests

- Peer recommendations from financial services HR communities and professional networks

- Industry conferences focused on HR technology in banking and financial services

- Consulting firms specializing in financial services HR transformation

Questions to Ask Potential Vendors

Effective vendor evaluation for best recruitment platforms financial institutions requires asking specific questions:

- Which financial institutions currently use your platform?

- What compliance certifications does your platform maintain?

- How are regulatory changes incorporated into platform updates?

- What happens to candidate data when contracts end?

- Can you provide references from banks with similar hiring volumes?

- What is your security incident response protocol?

- How does your platform handle multi-jurisdiction compliance requirements?

- Do you offer end-to-end solutions for streamlining the recruitment process in financial services?

Vendors who can answer these questions confidently with specific examples demonstrate genuine expertise in financial services recruitment rather than simply targeting the banking market with generic solutions.

Which Cloud-Based Recruitment Platforms Are Recommended for Banks?

Cloud-based ATS platforms have become the standard for financial institutions, offering advantages that on-premise solutions cannot match.

Why Banks Prefer Cloud-Based ATS Solutions

Scalability and Performance

Cloud-based ATS for banking platforms handle fluctuating hiring volumes effortlessly. Whether processing 100 applications or 10,000, performance remains consistent. This eliminates the capacity planning challenges and infrastructure investments required for on-premise systems.

Enhanced Security Posture

Contrary to outdated concerns about cloud security, modern cloud-based recruitment platforms often provide superior security compared to bank-managed on-premise systems. Leading cloud providers invest millions in security infrastructure, employ dedicated security teams, undergo continuous third-party audits, and implement cutting-edge threat detection that most individual banks cannot replicate.

Anywhere Access with Security

Cloud-based ATS enables recruiters, hiring managers, and candidates to access the system securely from any location. This flexibility proved invaluable during pandemic-driven remote work and continues to support hybrid work models and global hiring initiatives for financial institutions.

Automatic Updates and Innovation

Cloud platforms continuously improve without requiring disruptive update cycles. New features, security patches, regulatory compliance updates, and performance improvements deploy automatically, ensuring banks always operate on the most current, secure version of their banking recruitment software.

Reduced IT Overhead

Cloud ATS eliminates server maintenance, backup management, disaster recovery infrastructure, capacity planning, and software update coordination. This frees internal IT teams to focus on strategic initiatives rather than recruitment system administration.

Essential Cloud Platform Requirements for Banks

Financial institutions evaluating cloud-based recruitment platforms should require:

- Zero-trust security architecture

- Multi-region data hosting options for data residency compliance

- SLA-guaranteed uptime of 99.9% or higher

- Comprehensive disaster recovery and business continuity capabilities

- API-based integration supporting connection to existing HR systems

- Transparent security and compliance documentation

- Regular independent security audits and certifications

Cloud-Based Recruitment Software 2026

Cloud-Based Recruitment Software UK 2026

Best Applicant Tracking System 2026 | Top ATS Software Compared

Leading Cloud-Based ATS Options

While multiple vendors offer cloud-based recruitment platforms, those specifically designed for financial services deliver the compliance integration, security architecture, and industry-specific functionality that banks require when asking "what recruitment platforms or services are best for integrating with an existing HR team in a financial institution?"

Platforms built on modern cloud infrastructure provide reliable performance, reduced IT overhead, and secure candidate data handling that positions banks competitively in talent markets.

Frequently Asked Questions About Banking ATS

What is the best AI-powered ATS for the banking industry?

The best AI-powered ATS for banking industry combines advanced candidate intelligence with strict compliance workflows. It should automate shortlisting through resume parsing for banking jobs, reduce bias through bias-free hiring in banking algorithms, and support regulatory requirements like KYC and AML meets these criteria with its AI-driven matching, semantic resume analytics, and compliance-ready features specifically designed for financial services ATS requirements.

Where can I find compliance-centric recruitment software for financial services?

Compliance-centric recruitment software for financial services can be found through HR-tech marketplaces, vendor demos, and fintech HR communities. Look for systems with built-in KYC/AML workflows, GDPR controls, ATS compliance audit trails, and secure access features. The best financial services recruitment software will clearly demonstrate how compliance workflows are integrated—not just mentioned as an add-on.

Which cloud-based recruitment platforms are recommended for banks?

Banks should choose cloud-based recruitment platforms that offer enterprise-grade security, scalable performance, compliance management, and API integrations with HR systems. When asking "what recruitment platforms or services are best for integrating with an existing HR team in a financial institution?", platforms deliver secure cloud infrastructure specifically suited for financial institutions with built-in banking recruitment automation.

How does an ATS help improve candidate quality in banking?

By using AI-based screening and matching, a banking ATS ensures that applicants with relevant skills, certifications, and compliance readiness are prioritized through resume parsing for banking jobs—reducing manual errors and improving hire quality. The system's bias-free hiring in banking capabilities deliver 20-40% improvements in quality-of-hire metrics while ensuring regulatory compliance.

What makes an ATS suitable for a bank versus other industries?

An applicant tracking system for a bank requires specialized features including KYC AML compliant recruitment software workflows, GDPR compliant ATS for banks data handling, banking background verification software integration, ATS compliance audit trails, and understanding of financial services-specific roles and certifications. Generic ATS platforms lack these critical capabilities.

How quickly can a bank implement a new ATS?

With modern cloud-based ATS for banking platforms, implementation typically takes 4-6 weeks from contract signing to go-live, compared to 6-12 months for traditional on-premise systems. The cloud-native architecture and pre-built banking recruitment workflows significantly reduce configuration time.

What is the ROI of implementing a banking ATS?

Most financial institutions see positive ROI within the first year through 30-50% reduction in time-to-hire, 20-40% improvement in quality-of-hire, reduced external agency fees, lower bad hire costs, and improved recruiter productivity. The compliance risk reduction alone can justify the investment by avoiding regulatory penalties.

Can a banking ATS integrate with existing HR systems?

Yes, modern ATS for financial institutions platforms offer robust API integrations with HRIS systems, payroll platforms, background verification services, video interviewing tools, and e-signature solutions. This ensures seamless data flow and eliminates duplicate data entry across your HR technology ecosystem.

Conclusion: Banking Recruitment Requires Modern ATS Solutions

Modern financial institutions need more than a tracking system; they require a compliance-centric, AI-powered recruitment engine that addresses the unique challenges of banking recruitment in 2026.

The best ATS for banking industry platforms not only meet these demands—they accelerate hiring, reduce compliance risk, improve candidate quality, and enhance overall HR productivity. With banking recruitment automation, KYC AML compliant recruitment software, AI-powered candidate matching, and secure cloud-based infrastructure, these specialized platforms deliver measurable ROI while protecting your institution from compliance violations.

For financial institutions asking "which companies offer end-to-end solutions for streamlining the recruitment process in financial services?", the answer is clear: specialized banking ATS platforms that understand what is ATS in banking truly means—not just applicant tracking, but a comprehensive financial services recruitment software that integrates compliance, security, and intelligence into every step of the hiring journey.

Whether you're a large multinational bank, regional financial institution, or building society, implementing the right ATS for banks is no longer optional—it's essential for competing in today's talent market while maintaining the regulatory compliance and security standards your institution demands.

Ready to transform your banking recruitment? Explore how AI-powered ATS for banking can deliver faster hiring, better candidates, and complete compliance for your financial institution.

Contact: info@pitchnhire.com | https://pitchnhire.com/contact-us

Applicant Tracking System for Recruiters

Best Applicant Tracking System 2026 | Top ATS Software Compared

Best Applicant Tracking System 2026 USA | Top ATS Software

Best Applicant Tracking System 2026 UK | Top ATS Platforms

Best Applicant Tracking System 2026 Canada| Top ATS Software

Best Applicant Tracking System India 2026

Best Applicant Tracking System Online 2026 | Top 10 ATS

ATS Recruitment Software Comparison | Best ATS Comparison

Best ATS for Small Business Software

Best Applicant Tracking System 2026 Australia | Top ATS Software

ATS for High Volume Hiring 2026

ATS Tracking Systems UAE 2026 | Applicant Tracking Software

best applicant tracking system for small business

applicant tracking system for small business

healthcare recruitment software

staff scheduling software healthcare

healthcare employee scheduling software

Manufacturing Applicant Tracking System: Top 10 Recruitment Software

Top 10 ATS for Logistics Companies | Best Applicant Tracking Systems for Hiring

Hospitality Applicant Tracking System | Top 10 Restaurant Hiring Software

AI-Powered Applicant Tracking Systems